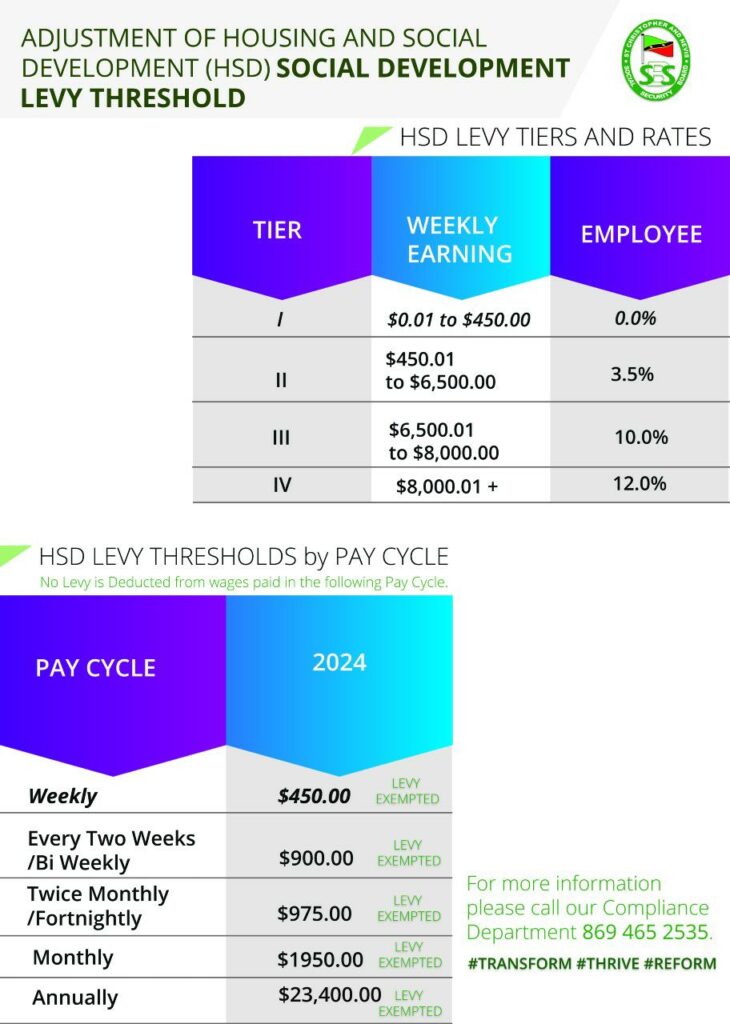

BASSETERRE, ST KITTS – WEDNESDAY FEBRUARY 21ST, 2024 – The St Christopher & Nevis Social Security Board wishes to advise the public of changes to levy effective March 1st, 2024. While the minimum wage was increased from $360.00 per week to $430.00 per week effective January 1st, 2024, the threshold for exemption from Housing and Social Development Levy is set at $450.00 per week. That is, only the Social Security deduction of 5% should be applied to employee wages between $0.01 to $450.00 per week.

Employers and Employees are advised to note these changes in accordance with the various pay cycles:

For persons who are weekly paid, no Levy will be deductible from wages up to and including $450.00

For persons who are paid every two weeks/bi-weekly, no Levy will be deductible from wages up to and including $900.00

For persons receiving wages twice per month or every half month, no Levy will be deductible from wages up to and including $975.00

For persons being paid on a monthly basis, no Levy will be deductible from wages up to and including $1,950.00

Further as it relates to employees earning over $6500.00 monthly, the following remains in place:

For Tier Two (persons crossing the threshold and earning up to and including $6,500.00 per month), Levy will be deductible at the continuing rate of 3.5% of total earnings.

For Tier Three (persons earning between $6,500.01 and $8,000.00 per month) Levy will be deductible at the continuing rate of 3.5% from earnings up to $6,500.00 and 10% from that portion of earnings between $6,500.01 and $8,000.00 per month.

For Tier Four (persons earning from $8,000.01 upwards per month) Levy will be deductible at the continuing rate of 3.5% from earnings up to $6,500.00; 10% from that portion of earnings between $6,500.01 and $8,000.00; and 12% from that portion of earnings from $8,000.01 upwards per month.

It is important to emphasize that the employer’s contribution on behalf of each employee is not affected by these changes. The employer’s portion of the Levy remains at 3% and is payable in respect of all wages paid.

Kindly note that this release supersedes any previous release pertaining to this matter.

The Board solicits the cooperation of all concerned. Insured persons and employers seeking clarification may review guidelines published on our website www.socialsecurity.kn or contact the Compliance Department on St Kitts at 869 465 2535 or 869 469 5245 on Nevis.

For more information, please contact:

Corporate Communications Department,

St. Christopher & Nevis Social Security Board

Phone:

869 465 2535 ext. 2710,2711 or 2712 – St. Kitts

869 469 5245 ext. 3402, 3400, 3410 – Nevis

869 667 2535

Email:

pubinfo@socialsecurity.kn